EB-5 Investment Amount vs other investor visas: comparative insights

Wiki Article

EB-5 Visa Explained: Exactly How to Obtain a Visa Through Financial Investment

The EB-5 Visa program presents a distinct chance for foreign investors seeking U.S. long-term residency with an organized financial investment approach. With specific eligibility criteria and financial investment thresholds, the procedure calls for cautious factor to consider and strategic preparation. Recognizing the subtleties of the application procedure, including the differences between local facilities and direct investments, is vital for potential applicants. As this pathway unfolds, possible financiers need to browse different advantages and challenges that accompany it. What are the critical variables that can influence the success of an EB-5 application?Review of EB-5 Visa

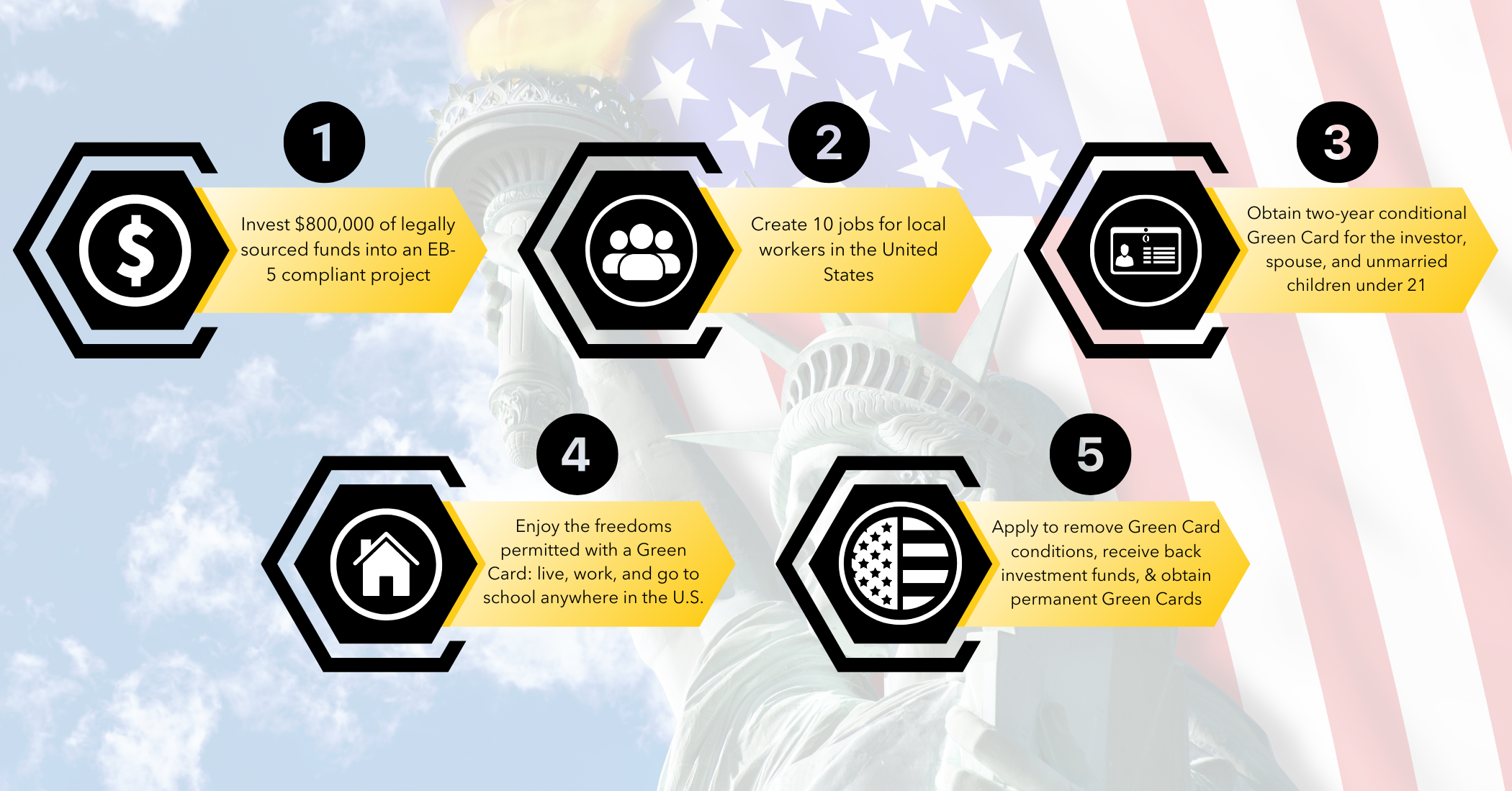

The EB-5 Visa program, created to promote the U.S. economy with international investment, provides a pathway to long-term residency for eligible investors and their households. Developed by the Immigration Act of 1990, the program aims to bring in international resources to create jobs and boost economic growth in the United States. Financiers that add a minimal total up to an accepted project can obtain this visa, therefore enabling them to buy various industries, including property, infrastructure, and other business enterprises.The EB-5 program is especially appealing as a result of its twin benefits: a chance for economic rois and the possibility for united state citizenship. By buying targeted work areas (TEAs), which are specified as rural regions or areas with high unemployment, financiers might get approved for a lowered investment threshold. The program requires the creation of at the very least 10 full time tasks for U.S. employees as a straight result of the investment. Effective applicants receive a conditional visa for two years, after which they can obtain irreversible residency, provided they meet all program demands. This pathway has actually gathered interest from financiers around the world, making it an important part of united state immigration policy.

Eligibility Requirements

To receive the EB-5 Visa, investors must meet details qualification requirements that assure their investment contributes to task development and financial development in the United States - EB-5. Most importantly, applicants need to spend a minimum of $1 million in a brand-new business, or $500,000 if the investment is made in a targeted work location (TEA), which is generally defined by high joblessness or country areasAdditionally, the venture needs to produce or preserve a minimum of ten full-time jobs for certifying united state workers within 2 years of the financier's admission to the United States. Investors are likewise needed to demonstrate that their financial investment funds were acquired through legal methods, offering evidence such as tax returns and financial institution declarations.

Another crucial criterion is that the investment must be in a for-profit business entity that was established after November 29, 1990, or one that has been restructured or expanded to meet the EB-5 requirements. Applicants need to demonstrate their intent to proactively take part in the business, making certain that their involvement contributes to its success. Fulfilling these eligibility needs is essential for financiers looking for to obtain irreversible residency through the EB-5 program.

Investment Options

When thinking about the EB-5 visa, investors should evaluate their choices in between direct investment opportunities and local center programs. Each selection lugs certain work production needs that are essential for meeting the visa standards. Comprehending these investment opportunities is necessary for making an educated choice that aligns with both monetary objectives and migration goals.Direct Investment Opportunities

Direct investment possibilities under the EB-5 Visa program provide international investors with a pathway to acquire united state long-term residency while adding to the American economy. Unlike regional facility financial investments, direct investments require financiers to proactively handle their service endeavors within the U.S., allowing for prospective better control and influence over their investment outcomes.To receive the EB-5 Visa with straight financial investment, international nationals have to invest a minimum of $1 million in a new business or $500,000 in a targeted employment location, which is defined as a backwoods or a region with high joblessness. The investment should bring about the production of at the very least ten permanent work for qualifying U.S. employees within two years.

Direct financial investment alternatives can vary widely, incorporating fields such as property advancement, modern technology, hospitality, and manufacturing startups. Financiers should conduct detailed due persistance to examine the viability of their chosen service model and assurance compliance with EB-5 regulations. Engaging with financial and legal professionals experienced in EB-5 matters is advisable to browse the intricacies of straight investment chances and optimize the capacity for an effective application.

Regional Facility Programs

Leveraging the EB-5 Visa program, regional facility programs supply a structured financial investment opportunity for international nationals looking for U.S. permanent residency. These programs are marked by the U.S. Citizenship and Immigration Solutions (USCIS) and focus on merging investments to fund various financial growth jobs, which might consist of realty, framework, and business enterprises.Investors typically add a minimum of $900,000 in targeted employment areas or $1.8 million in various other areas. EB-5. Among the main benefits of local center programs is that they enable capitalists to meet the EB-5 investment needs through indirect task production, in contrast to guide task development required in straight investment chances

Regional centers handle the financial investment in support of the financiers, using a much more passive approach than direct financial investment. This administration consists of supervising project advancement, monetary reporting, and conformity with USCIS policies. Additionally, local centers commonly have developed performance history, improving the self-confidence of potential capitalists.

Inevitably, local facility programs provide a compelling alternative for those seeking to browse the complexities of the EB-5 Visa process while adding to U.S. financial development and task creation.

Job Production Demands

To get approved for an EB-5 Visa, financiers need to validate that their funding investment results in the development of at the very least 10 permanent jobs for united state employees within 2 years. This work creation requirement is an essential part of the EB-5 program, developed to promote the united state economic climate and advertise economic growth.Capitalists can choose between 2 main financial investment choices: straight investments and investments through Regional Centers. With straight investments, the financier must proactively take care of the service and warranty job creation, while also demonstrating that the jobs created are for U.S. residents or authorized long-term homeowners. On The Other Hand, Regional Center investments enable capitalists to merge their sources into a designated job, frequently resulting in indirect work creation, which can be counted towards meeting the job requirement.

To successfully meet the work development requirements, it is very important for financiers to function very closely with experienced professionals that can guide them through the complexities of the EB-5 program. Proper preparation and adherence to laws are crucial to confirm compliance and protect a course to permanent residency. Failure to fulfill these task creation demands can endanger the investor's EB-5 application and their immigration status.

The Application Process

The application procedure for the EB-5 visa includes a series of important steps and details qualification requirements that candidates must meet. Recognizing these standards is vital for a successful application. This section will certainly lay out the needed credentials and give a step-by-step guide to steering via the process.

Eligibility Needs Overview

Recognizing the eligibility demands for the EB-5 visa is important for potential capitalists aiming to obtain permanent residency in the United States. To certify, a specific need to demonstrate a minimal financial investment of $1 million in a brand-new company, or $500,000 if the investment is made in a Targeted Employment Area (TEA), which is defined as a rural area or one with high joblessness.Moreover, the investor needs to show that the financial investment will produce or protect at least ten full-time tasks for U.S. workers within 2 years of the financial investment. The enterprise needs to likewise be a for-profit entity and has to be freshly developed or considerably renovated if it is an existing organization.

The candidate should verify that the investment funds are acquired via lawful methods, including individual cost savings, gifts, or lendings sustained by correct paperwork. In addition, the financier needs to actively join business, guaranteeing their involvement in the monitoring of the enterprise. Fulfilling these eligibility standards is essential for an effective EB-5 application and eventually protecting a copyright through this investment avenue.

Step-by-Step Treatment

When eligibility needs are met, possible capitalists can begin the application procedure for the EB-5 visa. The initial step involves completing Type I-526, the Immigrant Petition by Alien Investor. This form needs to be gone along with by sustaining paperwork that shows the capitalist's certifying financial investment and the creation of at the very least ten permanent tasks for united state employees.Upon approval of Form I-526 by the United States Citizenship and Immigration Solutions (USCIS), financiers can apply for the EB-5 visa through either consular processing or adjustment of status, relying on their current residency. For those outside the U.S., this means sending a visa at a united state consular office. Conversely, if currently in the united state, applicants should file Type I-485, Application to Register Permanent House or Change Standing.

After approval, financiers and their eligible member of the family get conditional long-term residency for 2 years. Within 90 days before the expiration of this conditional condition, investors have to submit Type I-829, Application by Entrepreneur to Get Rid Of Conditions, to acquire long-term residency. Successful conclusion of this action finalizes the EB-5 investment process, providing the investor a Visa.

Regional Centers vs. Straight Investments

Navigating the EB-5 visa program includes an essential decision in between direct financial investments and local facilities, each offering distinctive paths to acquiring long-term residency in the United States - EB-5 Visa by Investment. Regional centers are marked by the USA Citizenship and Migration Solutions (USCIS) to advertise financial development through work production. When spending via a local facility, investors normally add to a pooled fund, which is managed by the. This option typically enables a much more passive financial investment strategy, as the facility supervises the job and work development requirementsOn the other hand, straight financial investments require financiers to proactively manage their own service ventures in the USA. This method demands an extra hands-on participation, as the financier needs to sustain and produce at the very least ten full time work directly relevant to their service. While direct financial investments might use higher control over the investment end result, they also entail higher duties and dangers.

Eventually, the option in between local centers and direct financial investments hinges on specific risk tolerance, desired involvement level, and investment objectives. Recognizing these differences is important for capitalists seeking to navigate the complexities of the EB-5 visa program efficiently.

Advantages of the EB-5 Visa

The EB-5 visa program uses countless benefits for foreign investors looking for permanent residency in the United States. Among the most significant benefits is the opportunity for financiers and their prompt family participants, consisting of partners and youngsters under 21, to acquire an environment-friendly card, approving them the right to function and live in the united state indefinitely.

The EB-5 program does not need an enroller, allowing financiers higher freedom in their immigration journey. This program likewise supplies a pathway to citizenship after 5 years of irreversible residency, helping with long-lasting stability for family members. Additionally, spending through marked Regional Centers can be less cumbersome, as these entities frequently handle the job and job creation needs on behalf of the investor.

The EB-5 visa can lead to substantial financial returns, as investments are usually guided toward business ventures that can produce earnings. By adding to economic growth and task development in the United state, EB-5 capitalists play an important function in boosting regional communities. Overall, the EB-5 visa works as a compelling option for those aiming to safeguard a future in the United States while making a positive impact.

Usual Obstacles and Considerations

While the EB-5 visa program presents eye-catching benefits for international investors, it also includes its share of difficulties and considerations that possible candidates need to very carefully evaluate. One substantial challenge is the financial commitment entailed, as the minimal investment amount is substantial, normally evaluated $1 million or $500,000 in targeted work areas. Capitalists should ensure that they have adequate funding and a clear understanding of the connected threats.

Prospective financiers need to carry out complete due persistance on the financial investment jobs to prevent illegal plans. The success of an EB-5 application depends upon the creation of at the very least ten permanent work for united state workers, demanding cautious planning and monitoring of business's performance (EB-5 Investment Amount). Ultimately, navigating these difficulties calls for a critical method and frequently the advice of knowledgeable experts in immigration and investment law

Frequently Asked Concerns

For how long Does the EB-5 Visa Process Generally Take?

Can Household Members Apply With the Main EB-5 Candidate?

Yes, household participants can use along with the key candidate. EB-5 Visa by Investment. Eligible dependents usually consist of partners and unmarried children under 21, allowing them to obtain permits contingent upon the key candidate's successful visa approvalWhat Takes place if My Investment Stops working?

If your financial investment stops working, it may endanger your immigration condition and the potential for getting an eco-friendly card. It's important to carry out comprehensive due persistance and take into consideration danger reduction techniques prior to proceeding with any type of financial investment.Exist Age Restrictions for EB-5 Investors?

There are no details age limitations for EB-5 investors; however, the private must be at the very least 18 years old to legitimately become part of financial investment agreements. Minors might certify via parental investment and sponsorship.Can I Travel Outside the U.S. Throughout the Application Process?

Traveling outside the U.S. during the application process might impact your condition. It is advisable to talk to a migration attorney to understand prospective threats and guarantee conformity with all demands while your application is pending.Regional focuses take care of the financial investment on behalf of the investors, providing a much more easy strategy than straight investment. To certify for an EB-5 Visa, financiers should confirm that their resources financial investment results the original source in the creation of at the very least 10 full-time jobs for United state employees within 2 years. Financiers can pick between 2 main financial investment options: direct investments and investments with Regional Centers. The investor should show that the investment will certainly create or preserve at least 10 full-time jobs for U.S. employees within two years of the investment. Inevitably, the selection between direct financial investments and regional facilities hinges on private risk tolerance, desired participation level, and financial investment goals.

Report this wiki page